Don’t Get Tricked: 419 Advance Fee Fraud Explained

Understanding Nigerian 419 Advance Fee Scams

According to the Securities and Exchange Commission (SEC), an advance fee fraud is a scam where a victim is asked to pay money upfront in exchange for the promise of receiving something more valuable later. These schemes are far from new and have been around for well over a century.

One of the earliest known examples is the “Spanish Prisoner” scam, which dates back more than 100 years. In this scheme, scammers wrote letters to wealthy individuals claiming that a member of a rich Spanish family was being held in prison.

Victims were asked to send a small payment to help secure the prisoner’s release, with the promise that they would later share in a large fortune. Once the money was sent, it became clear that neither the prisoner nor the fortune existed.

By the 1980s, modern versions of advance fee fraud began emerging from Nigeria. Initially, these scams were sent through traditional mail, but as digital communication became cheaper and more accessible, they quickly moved to email.

These scams are commonly known as “419 frauds,” named after Section 419 of the Nigerian Criminal Code, which addresses fraud-related crimes.

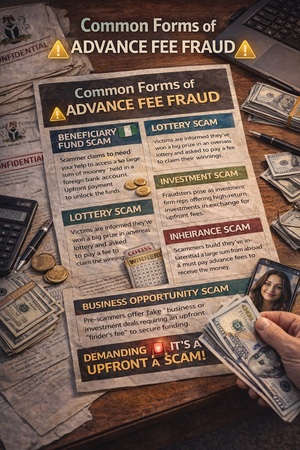

Common Forms of Advance Fee Fraud

Since the rise of 419 fraud letters in the 1980s, scammers have continually adapted and expanded their techniques. Today, advance fee fraud schemes come in many forms and are limited only by the creativity of the criminals behind them.

These scams often involve fake offers for products or services, fraudulent investment opportunities, lottery winnings that don’t exist, claims of “found money” or unexpected inheritances, and false business or funding proposals.

In some situations, scammers claim they can help individuals or businesses secure funding in exchange for an upfront finder’s fee. Once the fee is paid, victims learn they are not eligible for the funding—and the scammer disappears.

Below are some of the most common types of advance fee fraud.

Beneficiary Fund Scam

In this scam, the fraudster claims they need your help to access money held in a foreign bank account. The story often involves a deceased person and a sense of urgency.

Lottery Scam

Victims are informed that they have won a large prize in an overseas lottery. They are then asked to provide personal information or pay advance fees to verify their identity or process the winnings.

Investment Scam

Scammers pose as representatives of well-known investment firms or government agencies, offering overseas investments with guaranteed high returns. The promised profits never materialize.

Romance Scam

Fraudsters target people on dating sites or chat platforms, building emotional relationships over time. Once trust is established, they begin asking for money.

What to Watch Out For

The Federal Bureau of Investigation (FBI) recommends staying alert for offers that sound too good to be true, verifying who you are dealing with, and seeking professional advice when details are unclear.

Be cautious of businesses that lack a physical address, avoid direct communication, or demand secrecy to prevent independent verification.

Stay Vigilant

In today’s digital world, scammers can easily hide behind fake identities and impersonate legitimate people or organizations. Awareness, skepticism, and patience remain your strongest defenses against advance fee fraud.