Loan Repay Scams

Guard against loan repay scams that lure individuals with false promises of convenient repayment terms. These deceptive schemes can result in financial harm and identity theft. Stay informed to protect yourself from falling prey to fraudulent loan offers.

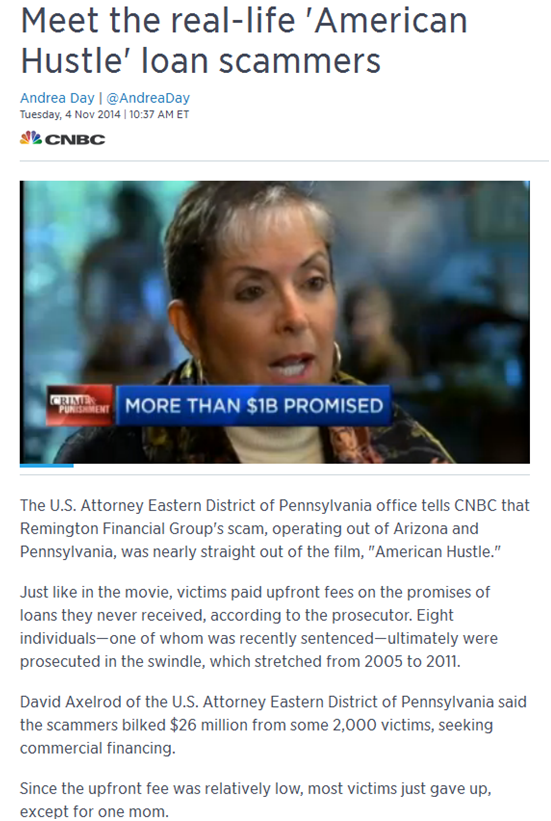

Scammers, driven by malicious intentions, significantly contribute to the negative atmosphere of websites. They inundate the target audience with numerous fraudulent emails, aiming to deceive them into parting with their money, ranging from a few dollars to substantial amounts.

While literate and well-informed individuals manage to evade the dangerous targets set by scammers, many illiterate and poorly informed people end up losing several hundred dollars to these criminals. Despite authorities taking steps to curb these activities, the situation demands more attention, as criminal activities on websites continue to grow exponentially without adequate control.

Scams associated with loan repayment are gaining momentum, and several hundred such scams have already occurred in various countries. Due to a lack of sufficient awareness about these types of scams, scammers take advantage of the situation and play their criminal role by swindling money from unsuspecting individuals.

Overseas Education Loan Scams: Beware of Fraudulent Recovery Tactics

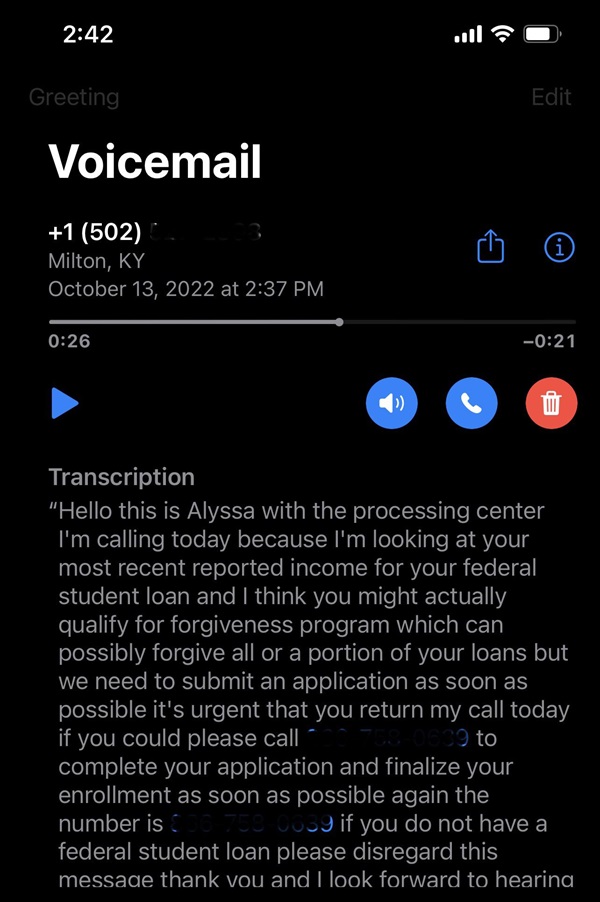

Students aspiring to pursue higher education abroad often search for affordable loans with attractive interest rates, and major banks provide appealing offers to meet their needs. However, scammers, operating from various locations worldwide, exploit the relaxed repayment norms of these education loans. Posing as fake loan recovery officers from the banks, they use aggressive tactics, including sending numerous intimidating emails to students. When students respond to these deceptive communications, scammers seize the opportunity to fraudulently extract money from them.

Scams related to school loan repayments are on the rise, prompting numerous complaints to the US Department of Education from concerned parents. Many students benefit from education loans provided by banks and are expected to repay them over time. However, scammers disguise themselves as loan consolidation officers, attempting to extract money from both students and their parents. They often use deceptive emails that convey messages like, "We are a leading financial institution offering consolidation loans at an exceptionally low interest rate. Respond to this email promptly if you wish to avail of these loan opportunities."

In response to these deceptive emails, when parents or students engage with the scammers, they often request a deposit of a few dollars as processing fees. Once the scammers receive the deposited money, they disappear immediately. Personal loan scams are equally prevalent, with scammers posing as reputable banks. They may craft emails claiming, "We are a distinguished bank in this country, providing personal loans at zero interest rates with fixed processing charges." Unfortunately, when individuals deposit the processing fees, the scammers abscond with the money.

Protecting Yourself from Loan Repayment Scams

The public is strongly advised not to respond to these fraudulent emails and take immediate action by reporting the matter to the cyber police. To safeguard your money, follow these essential guidelines:

- Never disclose your account number, online user ID, password, or other credit card details to third parties.

- Do not respond to scammers, as they may attempt to coerce you into depositing money.

- Report the incident to the police authorities and cyber cell to take necessary action against the scammers.

Loan Repayment Scams: Unraveling the Deceptive Web

Loan repayment scams are proliferating, with scammers employing cunning tactics to exploit unsuspecting individuals. These scams cut across various contexts, from education loans to personal loans, targeting vulnerable victims. The modus operandi often involves posing as legitimate authorities, such as bank officials or loan consolidation officers, creating an illusion of credibility.

Education Loan Scams: Scammers particularly target students pursuing higher education abroad, where they pose as loan recovery officers from reputable banks. These fraudsters employ pressure tactics, sending a barrage of emails to intimidate students into responding. Once engaged, they manipulate the situation to extract money, taking advantage of the financial vulnerabilities of students.

Personal Loan Scams: In the realm of personal loans, scammers pose as banks offering zero-interest loans with seemingly attractive terms. Victims are lured into depositing processing charges, only to find out later that they have been duped. These scams erode trust and financial well-being, leaving victims grappling with losses.

Common Warning Signs: To protect against these scams, individuals are advised never to share sensitive information, such as account numbers and passwords, with third parties. Ignoring communication from potential scammers, who often prompt victims to deposit money, is crucial. Victims are encouraged to escalate the matter to law enforcement and cybercrime authorities to curb the growing menace of these scams.

Guidelines for Public Safety:

- Never share account details, online user IDs, passwords, or credit card information with third parties.

- Exercise caution and refrain from responding to scammers who prompt for monetary deposits.

- Report incidents promptly to local police authorities and cybercrime cells.

By following these guidelines and remaining vigilant, individuals can shield themselves from falling victim to the intricate web of loan repayment scams.