Identity Theft Scams

Identity theft scams are on the rise in the digital age. Empower yourself by understanding the strategies cybercriminals use and adopt measures to safeguard your personal data from falling into the wrong hands.

"Identity theft" refers to the unauthorized acquisition and use of an individual's personal information, often through stolen, forged, or fraudulently obtained identity documents. This act often leads to the unauthorized access and control of the victim's existing financial accounts or the illicit creation of new accounts in the victim's name by the offender.

Identity theft not only leads to financial loss but also burdens the victim with the challenging task of rectifying the tarnish on their reputation. Addressing the fallout often requires substantial effort, as victims find themselves dedicating considerable time and resources to prove to banks, financial entities, and other organizations that they weren't the culprits behind the fraudulent activities tied to their name. Moreover, many face hurdles in reinstating their creditworthiness to its former state before the identity breach. When the identity stolen belongs to a deceased individual, their surviving family members inadvertently bear the brunt, navigating similar challenges and undergoing the accompanying emotional distress.

Steps to Safeguard Against Identity Theft

- Safeguarding both personal and business information is paramount. Criminals often sift through trash, hunting for identifiable data. Ensure you discard sensitive documents carefully to prevent potential misuse.

- Regularly shred or destroy obsolete documents like bank statements, utility bills, or credit card invoices to deter thieves from accessing valuable data.

- Exercise caution when disclosing personal details. Always inquire about how your data will be secured and be especially vigilant when sharing information over the phone or online. Confirm the legitimacy of the entity you're interacting with.

- Ensure your mailbox is secure. Mail often contains crucial information, making it a prime target for criminals looking to exploit your identity or accounts.

- Periodically review your bank and credit card activities. Spotting unauthorized transactions can be an early warning sign of identity theft.

- Regularly monitor your credit report to detect any unusual activities or credit checks, and immediately report any discrepancies you discover.

Guarding Your Identity

- In an age dominated by digital interactions, identity theft scams have become increasingly sophisticated, targeting individuals with the intent to exploit their personal information. From financial data to social security numbers, scammers employ various tactics to gain access to sensitive details.

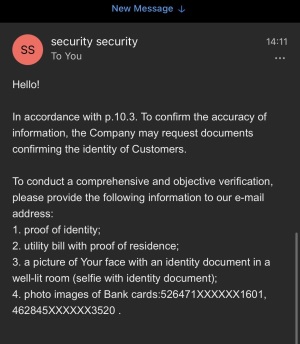

- Common identity theft scam methods include phishing emails, where unsuspecting individuals are tricked into providing personal information through seemingly legitimate messages. Another prevalent technique involves skimming devices attached to ATMs or point-of-sale terminals, enabling criminals to capture credit card details.

- Social engineering is yet another avenue employed by scammers, who manipulate individuals into divulging confidential information by posing as trustworthy entities. This can occur through phone calls, emails, or even fake websites designed to mirror legitimate ones.

- To protect against identity theft scams, it's essential to cultivate a heightened sense of awareness. Regularly monitor your financial statements for unusual activity, be cautious of unsolicited communication requesting personal information, and consider using credit monitoring services.

- Employing strong, unique passwords for different accounts, enabling two-factor authentication, and updating privacy settings on social media platforms are effective preventive measures. Additionally, shredding sensitive documents before disposal and being cautious about sharing personal information in public settings further fortify your defenses against identity theft scams.