Pyramid Scheme Scams

A key characteristic of pyramid selling schemes is the dependence on recruiting new participants to the scheme for earning money and advancing within the structure. The cycle continues as these recruits, in turn, bring in more participants, creating a cascading effect. Pyramid schemes are deemed unfair trade practices due to their inherent unfairness to the majority of participants. The benefits for those at the top stem from those at lower levels, and, eventually, recruiting the necessary number of people becomes impractical, leading to diminished financial rewards for participants.

We have compiled a list of several reliable online scam fighting agencies to help you keep up to date on current and past pyramid scheme alert scams and its types.

Examples:

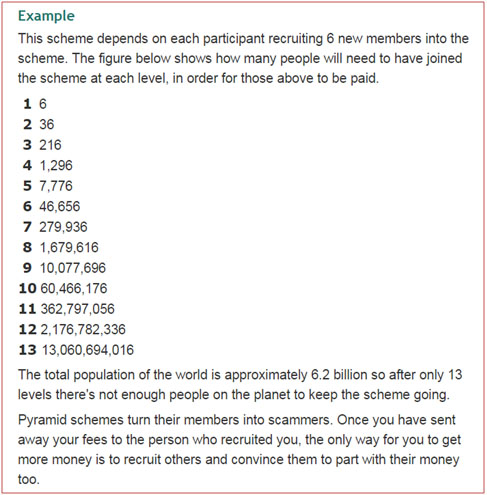

In this example the scheme depends on each participant recruiting 6 new members into the scheme. The figure below shows how many people will need to have joined the scheme at each level, in order for those above to be paid.

- 1 6

- 2 36

- 3 216

- 4 1,296

- 5 7,776

- 6 46,656

- 7 279,936

- 8 1,679,616

- 9 10,077,696

- 10 60,466,176

- 11 362,797,056

- 12 2,176,782,336

- 13 13,060,694,016

The global population stands at around 7 billion people. Consequently, after 13 levels, there aren't sufficient individuals on Earth to sustain the scheme. Some schemes incorporate the use of agents, supplied by the operators, who recruit others on behalf of participants, eliminating the need for individuals to recruit new participants personally.

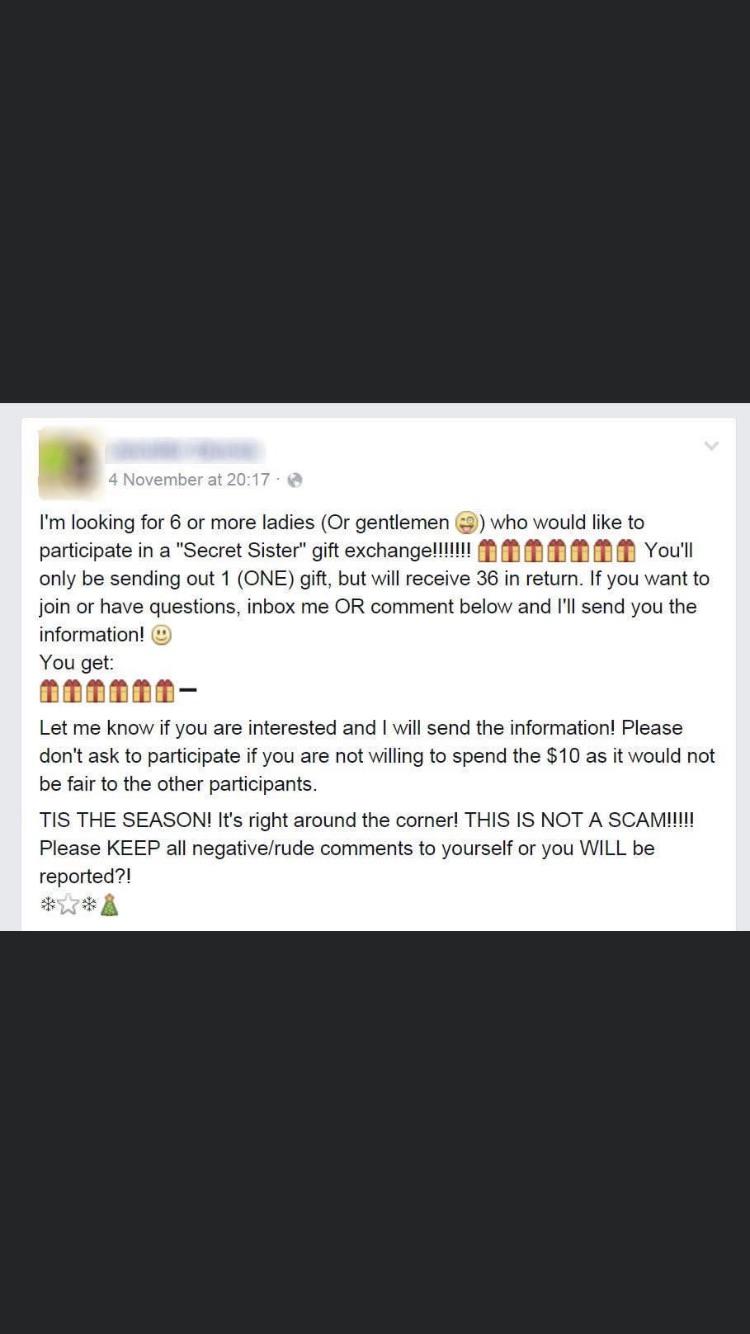

Christmas gift exchange, but it’s still a pyramid scheme.

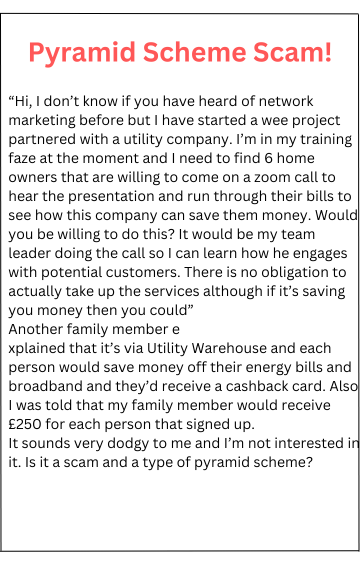

What is pyramid scheme?

A pyramid scheme is a marketing strategy employed by marketers to endorse a specific brand, product, or service. In this scheme, consumers or investors are enticed with the promise of substantial profits, contingent on the number of users they recruit to promote the brand. Pyramid scheme owners often recruit their initial group through seminars, personal phone calls, or mailings, employing an attractive promotion strategy to attract maximum users. The recruiter is then tasked with bringing in additional investors or recruiters, and the initial investor receives a commission based on the number of new participants joining the pyramid scheme.

Unraveling Pyramid Schemes: A Brief Overview

-

Pyramid Scheme Mechanics:

- Pyramid schemes operate on a model where earning money and advancing within the scheme depend predominantly on recruiting new participants.

- Participants are encouraged to recruit others, who, in turn, recruit more people, creating a cascading structure.

- The rewards for those at the top come from those below, and as the scheme grows, it becomes increasingly difficult to recruit enough people to sustain financial rewards.

-

Global Population Dynamics:

- With a global population of approximately 7 billion, after a certain number of levels, there won't be enough people on the planet to sustain the scheme.

- Some schemes involve participants using agents provided by the operators to recruit others, avoiding the need for personal recruitment.

-

Pyramid Scheme as a Marketing Strategy:

- Marketers adopt pyramid schemes to promote a brand, product, or service.

- Consumers or investors are promised substantial profits based on the number of users they recruit to promote the brand.

- Initial recruitment often occurs through seminars, personal calls, or emails, employing attractive promotion strategies.

-

Product Relevance in Pyramid Schemes:

- Many companies with non-bestselling products enter pyramid schemes.

- Products in pyramid schemes are often used primarily by recruits within the scheme, not the general public.

- Schemes rely on portraying a high demand for their products during promotions.

-

Real-Life Examples:

- Wealth Pools Scam (2007): A company selling DVDs globally froze assets after scamming people through a pyramid scheme, impacting 70k people from 64 countries, resulting in a loss of $132 million.

- Big Co-op Inc Scam: An internet shopping website in California operated a pyramid scheme, costing about 8.2 million dollars to approximately 1000 residents.

-

Legal Consequences:

- Pyramid schemes often involve legal repercussions. In the Wealth Pools case, the SEC froze assets, and in the Big Co-op Inc case, owners received a 20-year prison sentence.

-

Religious Scam Element:

- Some pyramid schemes, like Elite Activity, incorporate religious elements to attract participants, claiming divine inspiration and blessings for financial success.

An overview of pyramid scheme scam:

Many companies that struggle to sell their products resort to entering pyramid schemes. In such schemes, the products are frequently used only by the recruits within the scheme and not by the general public. Recruiters, when selling or promoting the product, often portray a false image of high demand. Scam companies often engage in pyramid schemes to attract investments from users. The product advertising is designed to be highly attractive, and commission rates are elevated during promotions. Unfortunately, many schemes dissolve, leaving numerous investors without having received their promised commission rates.

Below screenshot is an example of how a pyramid scheme works.

Whom do scammers target to enter the pyramid scam scheme?

- Scammers target old aged people who are retired and are looking for part time jobs.

- Women are another prospective target of scammers as they lure them in work from home and work in flexi time opportunities.

Examples of Pyramid scam schemes:

1. Wealth Pools pyramid scheme:

In 2007, a company called Wealth Pools was exposed for scamming numerous individuals through a pyramid scheme, leading to the freezing of its assets by the SEC. The company operated by selling English and Spanish DVDs through a global network. Users were encouraged to buy DVDs and resell them to make a profit. However, it was discovered that the actual profits came from adding new recruits to the pyramid scheme, not from reselling the DVDs. Ultimately, the company used the money from users as its profit. This scheme affected approximately 70,000 people across 64 different countries, resulting in a collective loss of $132 million dollars for the consumers.

2. 8.2 million dollars pyramid scam scheme:

Big Co-op Inc, an internet shopping website based in California, was found to be operating a pyramid scam scheme. Participants in this scheme were required to purchase a license, promising them commissions when they sold the company's products to external customers. Additionally, employees were encouraged to sell licenses to others as part of joining the company. Profits were not generated from the products sold by the company; instead, they were derived from the licenses purchased by new users. This fraudulent scheme resulted in a financial loss of approximately 8.2 million dollars for about 1000 residents of California. The owners of Big Co-op Inc were subsequently sentenced to 20 years of imprisonment.

3. The cycle of abundance pyramid scam scheme:

Harvey Joseph Dockstader Jr. from Texas orchestrated a pyramid scheme named Elite Activity, enticing participants to engage in a "cycle of abundance." In this fraudulent setup, individuals were required to make a "gift" in the form of a monetary contribution serving as an initial recruitment fee. They were promised significant profits upon recruiting new participants into the scheme.

This scheme could also be categorized as a religious scam, as Dockstader convinced many participants to join by asserting that his program was a divine work and inspired by God. He frequently invoked the name of God, assuring users that they would experience substantial profits as a blessing from the divine.

The hard truth of pyramid schemes in various countries:

- Pyramid schemes are free to operate in most of the countries without any specific rules and regulations, unlike America where the rules are a bit fuzzy.

- A recent study shows that, a group of people working against these pyramid scam schemes in china were physically attacked by gang leaders of these schemes.

- In Albania, almost two thirds of the people had invested in pyramid schemes which were tactically approved by the government itself.

Details of top companies being accused of pyramid schemes:

USANA Health Sciences :

This company was founded in early 90s, dealing in nutritional supplements. The company is a public company with net revenue of $790 million, which was accused of running pyramid scheme.

Nu Skin Enterprises :

Another public company accused of having adopted pyramid scheme is Nu skin enterprises. The company started its operation in the year 1984, selling supplements for skin care. The net revenue of this company was close to 2.57 billion dollars.

Mary Kay :

Mary Kay, a private company incorporated in 1963 dealing in cosmetics is another company that was involved in pyramid scheme. The net revenue was observed to be 4 billion dollars.

Herbalife :

Herbal life another public company founded in 1980, dealing in supplements and skin care holder of net revenue of 5 billion dollars, involved in pyramid scheme.