Shipping Fee Scams

Discover the red flags of shipping fee scams and safeguard your online purchases. Uncover deceptive practices, avoid fraudulent shipping charges, and ensure a secure shopping experience. Stay informed, save money, and shop with confidence!

Safeguarding Businesses in the Digital Era

In the modern era, companies worldwide are enhancing their business profiles and reaping substantial profits through internet and email channels. While thousands of legitimate business transactions occur seamlessly via email, the dark underbelly of scamming activities is also thriving in this digital domain. Scammers, operating under false identities, exploit mail correspondences to execute phishing schemes. Upon the recipient's response, these criminals set their plans into motion, leaving the target group as the ultimate financial victims.

Alarming data from authoritative sources reveals the staggering scale of these scamming activities. Over the past few years, various corporate entities and companies scattered across different countries have incurred losses amounting to a staggering $2.3 billion. The landscape is riddled with hundreds of notorious scams, particularly those related to shipping charges and fees. Many companies, irrespective of their global presence, have fallen victim to these schemes, losing substantial amounts exceeding $10,000.

As the digital realm continues to evolve, businesses must remain vigilant to protect themselves from the ever-present threat of email scams. This article sheds light on the magnitude of the issue while urging companies to adopt robust measures to safeguard against financial losses and reputational damage.

Protecting Your Business: Stay Alert to International Scams

In the realm of international business, scams are pervasive, with one classic example involving a buyer placing a bulk order with an ABC company. The scam unfolds as the buyer, appearing genuine, requests the company to deliver products to undisclosed destinations. The buyer, masquerading as an honest customer, initiates a contract by paying a small advance token, assuring the dealer of settling the balance upon delivery. However, the buyer provides fake credit card details and insists the dealer cover substantial shipping charges, cunningly adding them to the customary payment.

The buyer, seemingly innocent, instructs the dealer to swipe the amount after delivering the goods. Once dispatched, the scammer, now vanished, leaves the dealer with goods and a fake credit card. Similar scams involving PayPal fees and eday fees are gaining popularity. For instance, a buyer claims to include shipping charges with PayPal payment due to alleged issues with other transfer methods. Urging immediate transfer of shipping fees via Western Union Money Transfer, the seller, if deceived, risks losing the amount permanently.

To safeguard against such fraudulent activities, international business participants must exercise caution. The following guidelines offer valuable insights for those engaged in cross-border transactions:

Beware of these shipping fee scams

- Verify the authenticity of bulk orders, especially if the destination is undisclosed.

- Exercise prudence when dealing with advance payments and be wary of requests to cover shipping charges.

- Scrutinize buyer communication for red flags, such as urgency or unusual payment methods.

- Confirm the legitimacy of credit card details before processing transactions.

- Be cautious when urged to use specific money transfer services and validate such requests independently.

By adhering to these guidelines, businesses can fortify themselves against deceptive practices prevalent in international transactions.

Securing Global Transactions: A Guide to Avoiding Common Scams

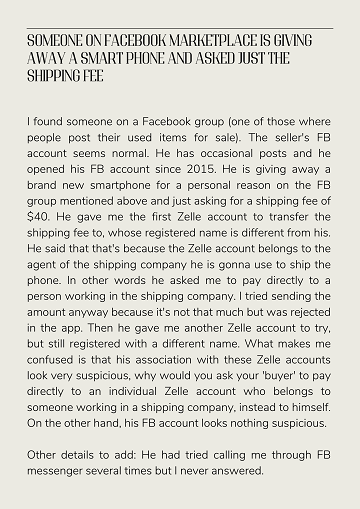

As technology advances, scammers continually adapt their tactics to exploit businesses in the international arena. Another prevalent scheme involves fake shipping fees where scammers pose as legitimate buyers. In this scenario, a fraudulent buyer initiates a transaction, paying a small token as an advance. Subsequently, they request the seller to bear exorbitant shipping charges, claiming reimbursement upon delivery.

The scammer, armed with a fabricated sense of trust, vanishes after receiving the goods, leaving the unsuspecting seller in financial distress. Moreover, instances of scams related to PayPal fees persist. A common ploy includes a buyer insisting on including shipping charges within the PayPal payment, citing issues with alternative transfer methods. The seller, trusting the buyer's explanation, may find themselves scammed when urged to transfer shipping fees through unconventional channels.

In light of these evolving threats, it's crucial for businesses engaged in global transactions to adopt proactive measures. Beyond vigilance, implementing secure payment gateways and conducting thorough background checks on unfamiliar buyers can fortify defenses against potential scams. The importance of educating employees on recognizing red flags and following established protocols cannot be overstated.

- Stay Informed: Regularly update your team on the latest scam tactics and trends.

- Verify Buyer Information: Scrutinize buyer details, especially when dealing with large or unfamiliar transactions.

- Secure Payment Processes: Utilize reputable payment gateways and avoid unconventional transfer methods.

- Establish Clear Protocols: Implement robust procedures for verifying transactions and communicating with buyers.

- Collaborate with Authorities: Report any suspicious activity to relevant authorities to contribute to a safer business environment.

By staying informed and implementing these strategies, businesses can reduce the risk of falling victim to scams, fostering a more secure and trustworthy international trade landscape.