Small Business Scams

Discover the ins and outs of small business scams and how to safeguard your venture. This guide provides insights into common fraudulent practices, outlines the risks entrepreneurs face, and offers effective strategies for scam prevention.

When flipping through the pages of your daily newspaper, it's inevitable to encounter numerous reports on business scams. Upon closer examination, a clear pattern emerges – scammers predominantly target small businesses rather than their more established counterparts. This strategic choice is grounded in the scammers' awareness that start-up businesses are more susceptible to falling into their traps.

Upon delving into the news, a discerning reader would notice that small business scams manifest in various forms. They can range from fraudulent invoices for supplies never ordered to unauthorized directory listings and advertisements. Exploiting technological advancements, scammers may go to extremes by gaining access to your supplier's account. This can be orchestrated by creating a fake website for your company, instigating a deceptive game between you and your supplier, ultimately leading to severe financial repercussions.

In the ever-evolving landscape of business scams, staying informed about these tactics becomes crucial for entrepreneurs. As technology advances, scammers adapt their methods, making it imperative for small business owners to remain vigilant and implement robust safeguards against potential scams. Remember, knowledge and awareness are key defenses in the ongoing battle against these deceptive practices.

Be cautious of the following small business scams:

False billing scam:

Recognizing that individuals managing the administrative aspects of a business may not always be privy to the promotional team's activities, scammers exploit this gap. They directly reach out to these personnel through phone calls or emails. Utilizing fabricated invoices, they coerce unsuspecting staff into making payments for advertising, domain name renewals, or directory listings that were never requested in the first place. This deceptive tactic capitalizes on the lack of communication within the business structure, leaving the administrative team vulnerable to financial manipulation by these fraudulent schemes. As scams continue to evolve, it is essential for businesses to fortify their internal communication channels and educate their staff to thwart such deceptive practices.

Recognizing that individuals managing the administrative aspects of a business may not always be privy to the promotional team's activities, scammers exploit this gap. They directly reach out to these personnel through phone calls or emails. Utilizing fabricated invoices, they coerce unsuspecting staff into making payments for advertising, domain name renewals, or directory listings that were never requested in the first place. This deceptive tactic capitalizes on the lack of communication within the business structure, leaving the administrative team vulnerable to financial manipulation by these fraudulent schemes. As scams continue to evolve, it is essential for businesses to fortify their internal communication channels and educate their staff to thwart such deceptive practices.

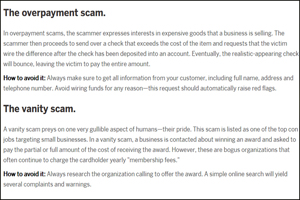

Overpayment scams:

This scam stands out as one of the most cunning ploys. Scammers employ a deceptive tactic by sending a payment cheque for a product they claim to have booked on your website. Typically, the cheque's amount exceeds the actual cost of the item. Subsequently, the scammer adeptly reaches out, requesting a refund for the purported overpayment, citing a mistake in the transaction.

This scam stands out as one of the most cunning ploys. Scammers employ a deceptive tactic by sending a payment cheque for a product they claim to have booked on your website. Typically, the cheque's amount exceeds the actual cost of the item. Subsequently, the scammer adeptly reaches out, requesting a refund for the purported overpayment, citing a mistake in the transaction.

Unaware of the impending deception, you may generously send back the extra amount. However, the insidious twist in this scheme becomes apparent when the payment cheque initially received bounces. In the end, falling victim to this clever overpayment scam results in both the loss of your product and the financial amount you unwittingly refunded to the scammer. As scams evolve in sophistication, staying vigilant and educating yourself about these deceitful practices becomes paramount to safeguarding against such financial pitfalls.

Malware scams:

Malware scams pose a significant threat to business individuals. Unlike other scams that primarily target financial assets, these scams involve con artists creating deceptive emails that mimic legitimacy, seemingly expressing interest in conducting a business deal. If you happen to click on the links embedded in these messages, your computer becomes susceptible to a virus that stealthily captures sensitive information such as your social security number, credit card details, and personal data stored on your system.

Malware scams pose a significant threat to business individuals. Unlike other scams that primarily target financial assets, these scams involve con artists creating deceptive emails that mimic legitimacy, seemingly expressing interest in conducting a business deal. If you happen to click on the links embedded in these messages, your computer becomes susceptible to a virus that stealthily captures sensitive information such as your social security number, credit card details, and personal data stored on your system.

The scammers compound their deceit by subsequently approaching you with a demand for a specified amount, ostensibly to clear the virus from your system. In these types of scams, the stakes are higher as they not only compromise financial security but also jeopardize the integrity of sensitive personal information. Vigilance and awareness are crucial defenses against falling prey to such sophisticated malware schemes.

received this message to a Business Suite inbox on Facebook. Scary the wording is professional and the link, which a friend checked out, looks like the real deal too. The giveaway is the profile that it came from. I won't be replying to this S-anal Prince!

Get protected with certain security measures:

Safeguard your office systems by regularly updating security software and adopting the practice of frequent password changes. Refrain from disclosing passwords unless there is a genuine and compelling reason to do so. In case you receive an email from your supplier's unfamiliar email address, take prompt action by contacting your supplier directly to verify the authenticity of the message.

Ensure that your company's filing and accounting systems are well-organized to promptly identify and respond to legitimate payment requests. Limiting the authority for purchasing or ordering goods to a select few individuals can be an effective measure to prevent falling victim to false payment schemes.

Exercise caution when dealing with instances of overpayment; verify the legitimacy of the cheque before initiating any refund. By maintaining a vigilant approach, you can shield yourself and your business from the unsettling consequences of small business scams that not only jeopardize your finances but also disrupt your peace of mind.

Scam that targets small businesses that I've seen a few times. Their whole schtick is selling these "awards.

Here are some additional insights into various types of small business scams and preventive measures:

-

Phishing Scams:

Scammers often employ phishing emails that appear legitimate, tricking individuals into revealing sensitive information. Be cautious of unexpected emails asking for login credentials or financial details. Always verify the sender's identity before responding.

-

Fake Invoices:

Fraudulent invoices for services never rendered or goods never ordered can catch businesses off guard. Implement a thorough invoice verification process, and train staff to scrutinize payment requests carefully.

-

Tech Support Scams:

Scammers may pose as tech support representatives, claiming there are issues with your computer or network. Avoid granting remote access to unknown individuals. Only engage with reputable IT support services.

-

Business Directory Scams:

Be wary of unsolicited calls or emails offering inclusion in business directories. Verify the legitimacy of the directory and the associated costs before agreeing to any listing or advertising services.

-

Impersonation Scams:

Scammers may impersonate executives or employees to manipulate financial transactions. Establish clear communication channels within the company, and implement verification protocols for sensitive transactions.

-

Ransomware Attacks:

Ransomware can cripple small businesses by encrypting important files and demanding payment for their release. Regularly back up crucial data, invest in robust cybersecurity measures, and educate employees on recognizing phishing attempts.

-

Online Shopping Scams:

Small businesses with online platforms may encounter scams where fake customers place orders but never pay. Implement secure payment gateways, monitor online transactions, and employ fraud detection measures.

-

Social Engineering Attacks:

Scammers may exploit human psychology to manipulate employees into divulging confidential information. Conduct regular cybersecurity awareness training to educate staff on recognizing and resisting social engineering tactics.

Preventive Measures:

Employee Training: Regularly train employees on cybersecurity best practices, including recognizing phishing attempts, verifying emails, and avoiding suspicious links.

Secure Online Transactions: Utilize secure payment gateways for online transactions, implement two-factor authentication, and regularly update your e-commerce platform.

Stay Informed: Stay updated on the latest scam techniques and educate your team accordingly. Awareness is a powerful tool in preventing scams.

Verify Communication: Encourage a culture of verification. Before making any significant payments or sharing sensitive information, verify the authenticity of the request through a trusted communication channel.

Legal and Regulatory Compliance: Stay informed about relevant laws and regulations related to data protection and online transactions to ensure compliance and protect your business.

By staying informed, implementing robust cybersecurity measures, and fostering a culture of vigilance within your organization, you can significantly reduce the risk of falling victim to small business scams. Regularly review and update your security protocols to stay ahead of evolving scam tactics.