Short and Long Firm Scams

Safeguard your business from Short and Long Firm Scams. Discover the strategies scammers employ, recognize warning signs, and implement effective prevention measures to ensure the security of your business finances.

Beware of Long and Short Firm Scams Targeting Businesses

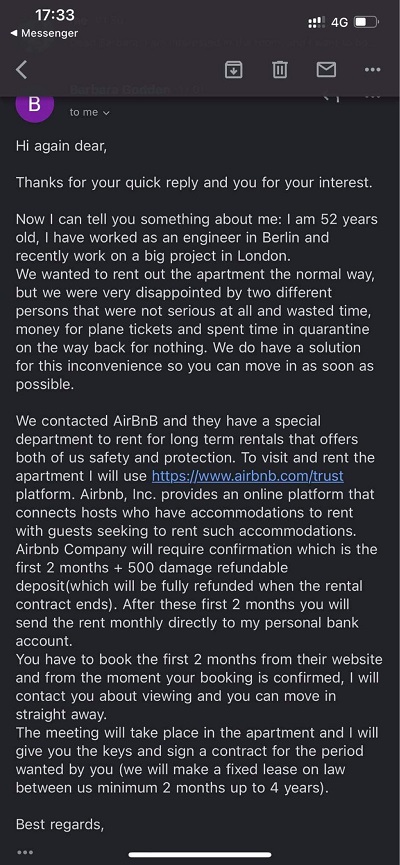

With the rising incidence of identity fraud in the form of long and short firm scams, businesses are being strongly cautioned to exercise caution against this prevalent threat. The long firm scam typically occurs after a business has established a solid credit history and goodwill, while the short firm fraud takes place in the early months of a business's operation. Despite their differences, the ultimate goal of both scams is the same: to extract money, leaving behind unfulfilled promises.

In these scams, fraudsters adopt the name and details of legitimate businesses, often targeting dormant companies. They escalate their order volumes, receive deliveries of stock, and vanish, leaving businesses to face financial losses. Remain vigilant, especially when dealing with unfamiliar entities, to safeguard your assets.

Fraudsters, aiming to acquire goods on credit, occasionally employ deceptive tactics, even at trade shows. Given that their sole intention is financial gain, they may employ various strategies to deceive unsuspecting individuals. Stay vigilant and be aware of their schemes!

To shield against long and short firm scams, directors of a reputable business advisory firm should enhance client-vetting procedures. This scrutiny should extend beyond clients to include suppliers, distributors, and all third-party individuals. Fraudsters may establish a business, posing as a legitimate trader who promises prompt payment but ultimately evades their financial obligations.

How can you avoid falling victim?

To minimize the risk of becoming a victim, implement a few precautionary measures. For instance, request partial payment upfront, consider making partial deliveries, and seek guarantees. Exercise caution if the previous payment is pending before fulfilling additional orders. Ensure that sales and credit control functions regularly communicate. If your business representative, after personally visiting the premises, detects any skepticism from the administrator, consult with experts and consider supplying only on a cash basis, if necessary. Be mindful of the following:

- Exercise caution when dealing with newly-formed firms.

- Gather more information about the directors/partners.

- Obtain details about their associated partners in trade and assess their credibility.

- Determine the duration they have been in business.

- Collect details about their current and past business addresses, including the duration they have operated from each address.

- Find out whether the premises are owned or leased, and if leased, inquire about the lease tenure. Fraudsters may occupy business premises when expecting a delivery.

- Always verify background information, previous trade activities, and overall reliability.

- It is crucial to know if the premise is primarily used as a delivery point.

Report the Scam

Take a stand against these scams by promptly reporting them to local authorities and the FTC. Your action can prevent others from falling victim to a false sense of security. Additionally, reporting may facilitate the recovery of your money or, at the very least, shield you from further unfair treatment.

A Practical Guide

Long Firm Scam: A long firm scam typically involves a fraudulent business that establishes itself as a legitimate and reliable entity over an extended period. These fraudsters invest time in building a positive credit history, creating a facade of trustworthiness. Once they have gained the trust of suppliers and other businesses, they place large orders for goods or services. However, when it comes time to settle the accounts, the scam artists disappear without making the payments. This type of scam often leaves the affected businesses with significant financial losses, as they have delivered goods or services in good faith.

Short Firm Scam: In contrast, a short firm scam is executed by a fraudulent business that operates for a brief period, typically just a few months. Despite the short timeframe, these scammers aim to quickly establish themselves as legitimate traders. They may imitate the details of a dormant or legitimate business, presenting themselves as trustworthy entities. In the short firm scam, the fraudsters focus on rapidly increasing their order volume. Once they receive the stock or services, they vanish without making any payments. The goal is to exploit the trust and goodwill of unsuspecting suppliers.

Common Tactics:

- Deceptive Strategies: Fraudsters use various deceptive strategies to appear genuine, including providing false business information and imitating legitimate businesses.

- Order Elevation: These scammers often start with small orders to build trust and gradually increase the order volume once the business relationship is established.

- Account Opening: Long and short firm scammers may attempt to open accounts with suppliers, distributors, and other third parties using fabricated information.

Preventive Measures:

- Enhanced Vetting Procedures: Businesses are advised to tighten client-vetting procedures for all parties involved, including clients, suppliers, and distributors.

- Risk Mitigation: Implement risk mitigation measures such as asking for part payment in advance, making part deliveries, and requesting surety.

- Regular Checks: Regularly review and authenticate the information provided by clients, especially those with newly-formed businesses.

Reporting: If you become a victim of a long or short firm scam, it is crucial to report the incident to local authorities and relevant agencies like the Federal Trade Commission (FTC). Reporting helps in raising awareness, protecting others, and may aid in the investigation and recovery process. Remember, vigilance and thorough due diligence are key to protecting your business from falling prey to these deceptive practices.