Banking and Phishing Scams

As the digital era progresses and e-money becomes more prevalent, banking scams are on the rise. Every

bank customer, irrespective of their online expertise, is susceptible to these scams. Given that all

money-related sources can become scammer targets, every banking product is potentially at risk.

The internet is a primary medium for banking and phishing scams. With online banking becoming more accessible and convenient for users, fraudsters have found ways to exploit it. They create fake banking websites that look legitimate, tricking unsuspecting users into providing confidential information. The deceptive websites, combined with phishing emails, are potent tools in the hands of scammers.

Phishing, one of the most prevalent scams, involves scammers creating a copy of a bank's website or email. Victims are tricked into entering sensitive information, which the scammer then uses for fraudulent activities. These phishing attacks often come through emails, but can also occur during online payments. When users are making payments, they can be redirected to phishing sites that capture their credit card details.

Various Manifestations of Banking and Phishing Scams

Counterfeit Bank Websites

Fraudsters craft fake banking websites that seem legitimate. They lure users, often through emails or text messages, into entering sensitive details like bank account passwords, credit card numbers, and PINs.

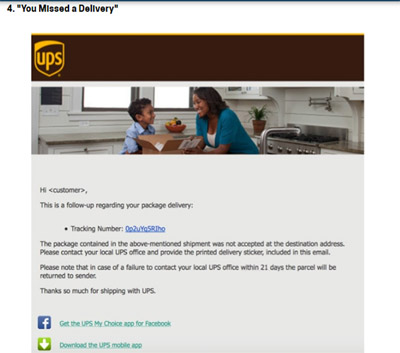

Email Phishing

Scammers send emails that closely mimic official bank communication. The goal is to redirect users to fake banking sites where their credentials can be stolen.

Credit Card Deceptions

Among banking scams, credit card deceptions are prominent. Scammers, pretending to represent the victim's bank, might offer enticing credit card deals. They solicit sensitive data, ostensibly to process the card, only to commit fraud later.

Identifying Fake Banking Websites and Phishing Emails

- Counterfeit bank sites often have unexpected pop-ups soliciting data, whereas most genuine banks avoid such interruptions.

- There are often subtle differences in design or URL which can give away a fake site.

- Scammers frequently employ phishing emails to lead victims to these sites.

- Such emails, designed to cause panic or urgency, often come with spoofed links.

- A close examination will reveal that these emails often follow a similar pattern or template.

Preventive Measures against Banking and Phishing Scams

- Always manually type your bank's URL instead of clicking on links from emails or text messages.

- Avoid clicking on links from unsolicited or suspicious emails.

- Remember, banks typically don't ask for personal information via email or text.

- When in doubt, call your bank to verify any communication received.

- Engage in discussions with friends and family before responding to suspicious emails.

- Strengthen your account security using two-factor authentication whenever possible.

In conclusion, the rapid digitization of banking has made life more convenient, but it's also opened the door for more scams. By being vigilant and informed, you can protect yourself from falling prey to these deceptions.