Pay in Advance Credit Offers Scams

Be wary of pay in advance credit offers that may be scams. Learn to identify advance fee scams, understand the risks of credit fraud, and exercise caution when dealing with financial offers that demand upfront payments. Stay informed and protect yourself from falling victim to deceptive practices.

Beware of 'Pre-Qualified' Offers: The Hidden Costs of Processing Fees

Some companies may assert that you've been "pre-qualified" for a low-interest loan, credit card, or even credit repair, despite facing rejection from banks. However, to avail yourself of the offer, you're required to pay a processing fee, often amounting to several hundred pounds or dollars.

Cautionary Advice:

The higher the offers they present, the greater the associated risk. Moreover, it is advisable not to respond to these emails.

Identifying Scams: How to Verify the Legitimacy of Claims

- Legitimate lenders never guarantee a card or loan before you apply.

- Authentic lenders may ask for application, appraisal, or credit report fees, but these are typically requested after the lender is identified and the application is completed.

- Fees are generally paid directly to the lender, not to a broker or the individual arranging the "guaranteed" loan.

Utilize Our Spam Checker Tool with Confidence

Explore our Spam Checker Tool designed for your convenience. Input the email address or contact number that raises suspicion, and our tool cross-references it with our extensive spam database. This ensures you receive accurate information about whether the email or phone number is legitimate or potentially fraudulent.

Report scams to the United States government by filing a complaint about scams or other crimes

Identifying Pay in Advance Credit Offer Scams:

The pay-in-advance credit offer scam typically unfolds with the victim receiving a guarantee for a substantial loan or credit. To add an air of legitimacy, the scammers send seemingly authenticated documents and loan contracts, aiming to convince individuals that they are engaging with a credible service. These documents often feature stolen names of reputable lenders and include fake logos for the company.

The subsequent phase involves frequent calls and emails from the scammers, urging the customer to provide their personal information for form filling or further processing. This step is executed with finesse and professionalism, as customers are naturally cautious when sharing their details.

Scammers typically target customers with low credit ratings or those whose loan applications have been rejected by banks. Exploiting this vulnerability, customers are then informed that they need to pay a deposit for purposes like insurance premiums, down payments, or processing fees due to their questionable credit history and the loan amount applied for. The payment is usually instructed to be made via Western Union or Moneygram, promising a quick disbursement of the loan amount. Unfortunately, the customer falls victim to the scam, and the scammer disappears with both the money and all the information needed for identity theft.

Various forms of pay-in-advance credit/loan scams exist, but they all follow a common underlying strategy. In some variations, fraudulent loan companies make repeated demands for money, claiming that the customer's current credit report requires a larger deposit than initially quoted. Using false excuses, customers are coerced into paying substantial sums multiple times. By the time victims realize the deception and attempt to reclaim their money, the scammers have already relocated, ready to ensnare a new set of potential victims.

Tips for Detecting and Avoiding Pay-in-Advance Credit Offer Scams:

- Legitimate companies do not ask for deposits in advance of a loan, as they understand that such practices could lead to complaints and, if found guilty, cancellation of their license.

- Fees associated with a legitimate loan are typically deducted before fund disbursement; a genuine company will not request fees to be transferred via Western Union or Moneygram.

- Avoid responding to calls, emails, or letters from cash advance companies or agencies offering loans or credit.

- Be cautious if you fall for their pending receipt trick, as frequent demands will follow to pay a substantial amount to complete the loan process.

- Remember that legitimate lenders do not post ads; avoid responding to loan solicitations in classified ads.

- Beware of offers posted on popular social networking platforms like Twitter, Facebook, etc.

- Ensure you land on the same page after clicking on the company's website link.

- Legitimate lenders never guarantee credit or a loan before you actually apply for it.

- Avoid common phrases like "Bad credit, no credit, no problem," "loans available by applying online," or "call 1-###-###-####."

- Be wary of calls that guarantee a loan without a credit check; a lender who shows little interest in your credit history is likely a scammer.

- Verify details of the company on various online forums and check their reviews. Never provide personal details such as credit card numbers, bank account numbers, or social security numbers unless you are familiar with the company. Scammers may use this information for identity theft.

How Pay-in-Advance Fee Credit Offer Scam Artists Identify Their Victims:

Individuals who have recently applied for loans may unknowingly expose their need for financial assistance to companies beyond the one they applied to. Credit reporting agencies often make customer information available to anyone willing to pay a fee. This common practice is exploited by scam artists to obtain data about potential victims. Therefore, exercise caution when providing personal details, as they may end up in the hands of unscrupulous scammers who could use them for criminal activities, with repercussions directed towards you. If you feel victimized, promptly report the case to your state authorities and cease any communication with the fraudster.

Real-Life Examples of Advance Fee Loan/Credit Payment Scams:

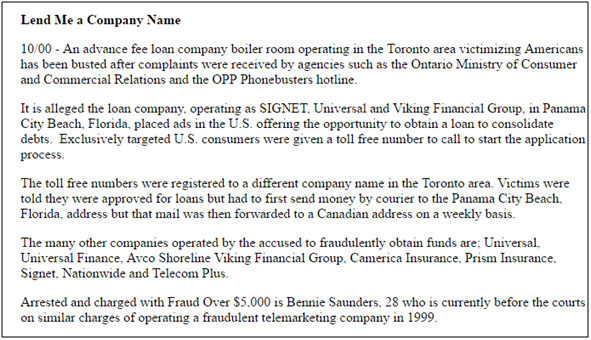

- Bennie Saunders, 28, faced charges of $5,000 for fraudulently obtaining funds under the names of several telemarketing agencies, including Universal, Universal Finance, Avco Shoreline Viking Financial Group, Camerica Insurance, Prism Insurance, Signet, Nationwide, and Telecom Plus. Operating in Toronto, the fraudster exclusively targeted U.S. customers. He would provide them with a toll-free number, and upon calling, they were informed that their loan had been approved, with the initial payment to be made through a courier service to Panama City Beach.

- The screenshot below depicts an individual who fell victim to THE BUSINESS SOLUTION. Evidently, he paid the company for the approval of his funds but has yet to receive the promised funds.

- Statewide Financial, a subsidiary company of Lafayette Lending Group, reported that its name is being fraudulently used to deceive customers in the guise of an advance fee loan. In this scam, customers are advised to pay a 1% fee to the company via Western Union for the loans to be approved.

- Leslie Card, 35, and Kevin Card, 33, both from Jamaica, were arrested in Ontario in January 2004 and charged with 22 felonies. They operated scams targeting people in Virginia and 22 other states, making millions of dollars through phony credit loan deals. Canadian authorities estimated their average daily scam earnings to be $10,000. Their tactics not only resulted in financial losses for victims but also exposed their personal details, leading to instances of identity theft. The largest reported amount scammed was $15,500 from a church janitor in Virginia.