Market Manipulation Scams

Guard against market manipulation scams and fraudulent trading. Stay informed to protect your investments from schemes like pump and dump and other securities fraud. Learn to recognize red flags and secure your financial well-being.

The prolonged integration of the global financial market, commonly referred to as the capital market, has presented unprecedented opportunities for U.S. businesses to secure capital and for investors to diversify their portfolios. However, as individuals opt to invest in U.S. securities and commodities markets, scammers are relentless, leaving no aspect untouched, including tampering within the capital markets. The occurrence of these scams is primarily linked to the expansive growth in this domain. The introduction of sophisticated investment instruments and a substantial increase in invested capital have provided fertile ground for both individuals and businesses to engage in deceptive investment schemes.

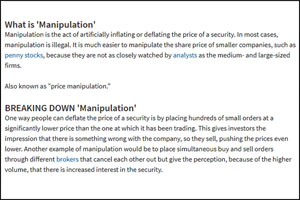

Encountering a scam in the stock or commodities market, officially labeled as market manipulation, can be profoundly disheartening. This article seeks to acquaint you with current concepts and offer guidance on navigating them cautiously.

Market manipulation takes on various forms, and the following are noteworthy types that require careful avoidance:

- Churning: This occurs when a speculator places both buying and selling orders at the same price, intending to attract the attention of other investors, with the aim of increasing the price.

- Runs, Ramping, or Painting the Tape: Referred to by any of these terms, this manipulation happens when a group of speculators creates activity or narratives to artificially inflate the price of a stock.

- Wash Trade: Not to be confused with a wash sale, this is another form of market manipulation in which an investor buys and sells the same financial products.

- Bear Raid (a stock market strategy): In this strategy, a trader or group of traders attempts to force down the price of a stock to cover a short position.

Warning Signs

- Significant disparities in bidding behavior

- Actions contradicting compliance manuals

- Unusual, nonrecurring transactions

If you aim to construct a successful portfolio, pay close attention to these warning signs. Exercise caution consistently and scrutinize any aspect of a company's income statement that raises concerns. Given their susceptibility to manipulation, both revenues and expenses should be thoroughly examined. Corporate management may have incentives manipulation, and auditors may not always detect it. Experts advise a thorough review of the income statement and the management's discussion of the company for insights, including the balance sheet, footnotes, and the cash flow statement.

Economic consultants can aid in responding to regulatory investigations, but conducting your own research and staying informed about capital market developments is crucial.

Strategies for Outsmarting Scams

Exercise caution at every juncture and employ the following strategies:

- Always maintain a skeptical approach

- Be wary of any exaggerated hype

- Independently verify claims, regardless of their perceived trustworthiness

- Investigate where the stock is traded

- Thoroughly research the investment opportunity

- Stay vigilant against aggressive pitches

Additional Strategies to Safeguard Against Scams

Enhance your ability to outsmart scams by incorporating the following practices into your investment approach:

- Diversify Your Investments: Spread your investments across different assets and sectors to minimize risk.

- Stay Informed: Keep abreast of market trends, regulatory changes, and news that may impact your investments.

- Consult Financial Advisors: Seek advice from reputable financial advisors to gain insights and perspectives on potential investments.

- Utilize Research Tools: Leverage financial research tools and platforms to conduct in-depth analysis before making investment decisions.

- Monitor Your Investments: Regularly review and assess the performance of your investments to identify any unusual patterns or discrepancies.

- Educate Yourself: Develop a solid understanding of financial markets, investment instruments, and common tactics used by scammers.

- Verify Company Information: Authenticate the legitimacy of companies by checking official records, regulatory filings, and other reliable sources.

By integrating these proactive measures, you can bolster your defenses against potential scams and make more informed investment choices.