Direct Debit Scams

Direct Debit Scams involve unauthorized or fraudulent transactions pulled from bank accounts using direct debit instructions. Often sophisticated and deceptive, these scams can lead to significant financial losses. Awareness and vigilance are paramount in recognizing and preventing such fraudulent activities.

The Evolution of Banking and the Emergence of Direct Debit Scams:

With the digital transformation of banking, processes like online transfers and internet banking have become second nature to many. Though these transitions come with fortified security, clever scammers often find loopholes, jeopardizing our financial safety.

Understanding Direct Debits:

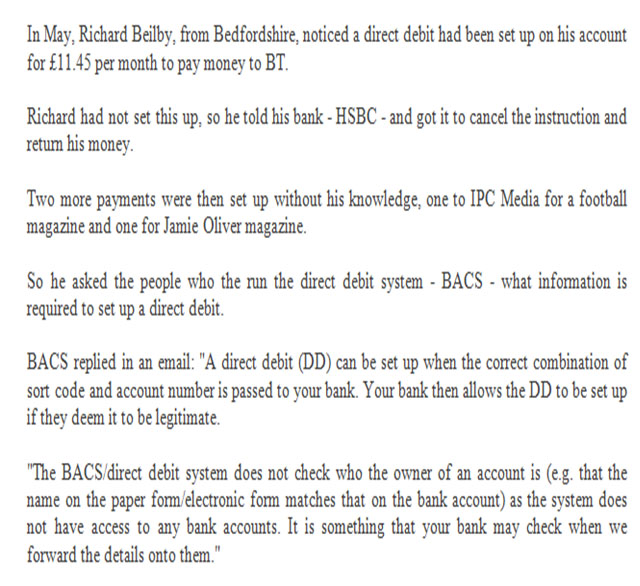

Direct debits are automated transactions triggered when the correct account number and sort code are provided. The most concerning aspect? No additional authentication is needed. This automatic process facilitates electronic transfers and, with paperless direct debits, not even a signature is required, which reduces the level of security.

Setting Up a Direct Debit:

Establishing a direct debit is straightforward if the following details are available:

- Your account name and number

- Your bank's sort code

- Bank's address

Navigating the World of Direct Debit Scams:

Though direct debits are designed with the customer's convenience in mind, they can be misused. Scammers often set up unauthorized direct debits, which unsuspecting victims only discover upon reviewing their bank statements.

Typically, a direct debit scam starts with a small credit, often as insignificant as a cent, to a target bank account. This minuscule amount contains a six-digit code. If the bank verifies this transaction, the gates open for future direct debits from the account. Leveraging sophisticated techniques, scammers infiltrate online banking systems to retrieve this vital code, setting the stage for unauthorized withdrawals.

Numerous instances exist where users unexpectedly find unauthorized direct debits. For example, a certain HSBC customer realized someone set up two direct debits without his consent.

Shielding Yourself from Direct Debit Scams:

- Consistently monitor your bank transactions. Familiarize yourself with every entry, no matter how minor.

- Avoid allowing direct debits from your account unless absolutely necessary.

- Any unexpected credit, even a small one, should be scrutinized. Such transactions often serve as precursors to direct debit scams.

- Request regular bank statements. Keeping a meticulous record helps track and challenge any discrepancies swiftly.

As we progress further into the digital age, it's imperative to remain vigilant. Scammers continually evolve their techniques, but with awareness and caution, we can safeguard our finances and peace of mind.